What Blended Families Should Know About Estate Planning

An estate plan with an Irrevocable Life Insurance Trust may help reduce estate taxes and ensure equitable distribution of a blended family’s assets.

Blended families have become common as the U.S. divorce rate now hovers between 40% and 50%. In blended families, the death of a spouse with children from a previous marriage can create complicated financial and emotional issues among surviving family members—even in families that have a positive dynamic.

In some cases, state inheritance laws and estate planning practices prioritize a surviving spouse above children. This treatment can create problems in blended families, especially when a second spouse is close in age to the children from a first marriage—potentially delaying the children’s expected inheritance. In these situations, children may feel shortchanged, or even disinherited, which can create anxieties that can compound the grief all parties feel for the loss of a loved one.

Using life insurance in an estate plan

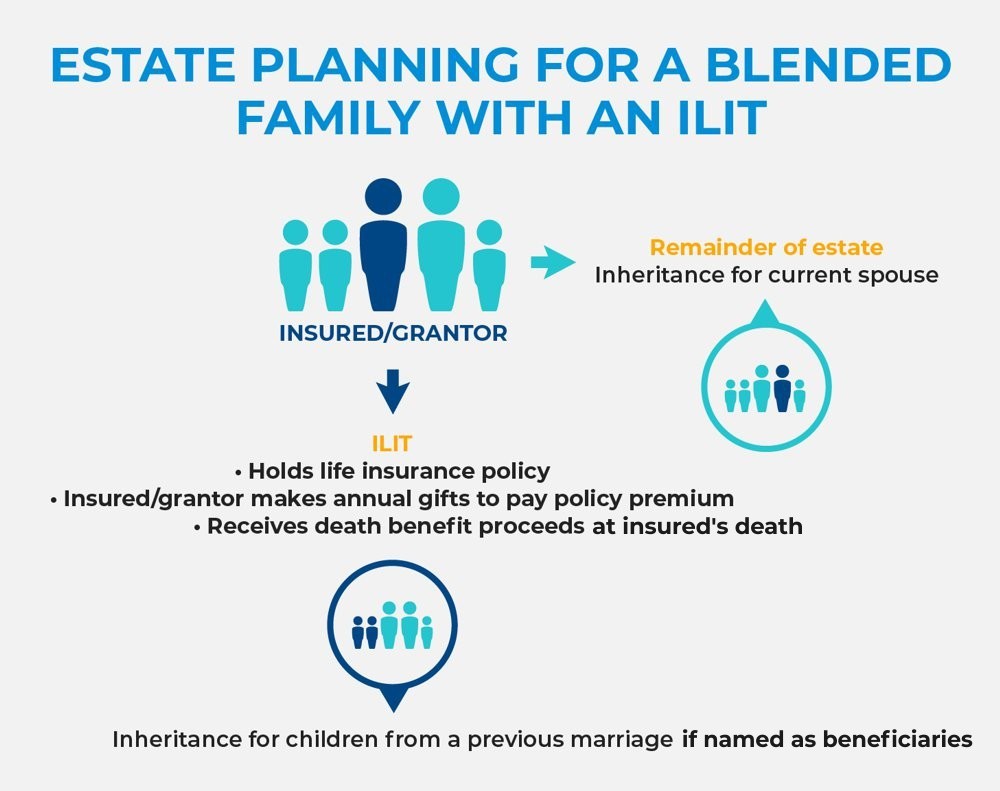

A life insurance policy may offer a way to provide family members with protection in the form of death benefit proceeds after the insured dies. When a life insurance policy is included in an estate plan that also features an Irrevocable Life Insurance Trust (ILIT), a blended family can potentially reduce estate taxes while carving out funds for specific beneficiaries to inherit.

An ILIT is a trust that may be established to hold assets, including a life insurance policy, outside of the grantor/insured’s taxable estate. The grantor then can make annual gifts to the trust to pay for premiums on the life insurance policy it holds. If those annual gifts to the ILIT qualify for the annual exclusion and/or lifetime gift tax exemption, they should not be subject to gift tax.

While a trustee (typically a close friend, a professional trustee or an extended family member) manages the trust, the insured/grantor names the trust beneficiaries. For example, in a blended family, the insured may choose to designate children from a previous marriage as beneficiaries. Then, when the insured passes away, the trust will receive the policy’s death benefit proceeds and may distribute those funds to the children under the terms of the trust. The surviving spouse may receive other assets as specified in the deceased’s will.

When properly structured, ILITs offer three primary benefits that can make them attractive for blended families seeking to reduce potential estate tax and treat surviving spouses and children fairly:

- Assets excluded from the grantor’s personal estate. Because the insurance policy is held by an irrevocable trust, the death benefit proceeds are distributed to the ILIT free from estate and income tax, after which they can be distributed to the beneficiaries pursuant to the terms of the ILIT. What’s more, gifts made to the trust during the insured’s lifetime to pay policy premiums also may reduce the size of the taxable estate inherited by the surviving spouse.

- May help surviving spouse maintain lifestyle. Using an ILIT to provide an inheritance for children from a previous marriage preserves other assets to provide for a current spouse’s financial security.

- Children receive inheritance before death of current spouse. Death benefit proceeds paid to the ILIT can be distributed to children, as the beneficiaries of the ILIT, within the terms of the trust, avoiding the need to wait for the death of the current spouse to receive whatever remains from the estate’s value.